Businesses are turning to online banking as convenient and efficient way to manage their finances. This article explores five key perks of having an online bank account for businesses, highlighting how it simplifies financial tasks, enhances security, improves cash flow management, and enables convenient transactions. Whether a small startup or a large corporation, online banking can revolutionize how you handle your finances.

1. Simplified Financial Tasks: Streamlining Operations

Online banking simplifies and automates many financial tasks, saving businesses valuable time and effort. With features such as online bill payment, recurring payments, and electronic fund transfers, businesses can easily manage their expenses, pay vendors and suppliers, and handle employee payroll efficiently. By eliminating the need for manual processes, businesses can reduce paperwork, minimize errors, and allocate resources to more strategic activities, ultimately boosting productivity.

2. Enhanced Security: Protecting Your Business Finances

Security is a top priority for businesses when it comes to financial transactions. Online banking offers robust security measures to protect your business finances. With advanced encryption, multi-factor authentication, and secure login procedures, online banking platforms ensure the confidentiality and integrity of your sensitive financial information. Additionally, real-time transaction alerts and the ability to set spending limits provide businesses with greater control and visibility over their accounts, detecting and preventing potential fraud.

3. Improved Cash Flow Management: Real-Time Monitoring and Forecasting

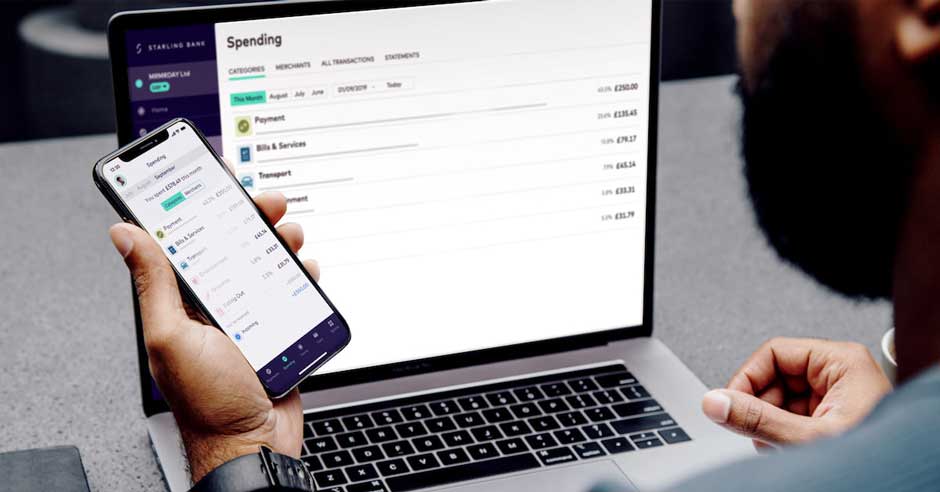

Managing cash flow is critical for businesses of all sizes. Online banking provides real-time monitoring and reporting tools that empower businesses to track income and expenses, view account balances, and analyze cash flow patterns. With up-to-date financial data at their fingertips, businesses can make informed decisions, optimize cash flow, and proactively address any potential cash flow gaps. Online banking also allows businesses to schedule payments and manage receivables, ensuring smooth financial operations.

4. Convenient Transactions: Anytime, Anywhere Banking

Online banking offers unparalleled convenience, allowing businesses to perform transactions anytime and anywhere. Whether you’re in the office, on the go, or traveling for business, you can access your online bank account through secure web portals or mobile banking apps. As stated by Chime, you can “Manage your money, find ATMs, and Pay Anyone right from the mobile app. No tellers, no lines, no buildings. Just a super-powered app. Chime makes managing your money easy and empowering.” This means you can initiate transfers, make payments, and manage your accounts conveniently, eliminating the need to visit a physical branch. With 24/7 access to your accounts, online banking ensures you’re always in control of your business finances.

5. Valuable Financial Insights: Data-Driven Decision Making

Data is a powerful asset for businesses, and online banking provides valuable financial insights to inform strategic decision making. Businesses can analyze their financial performance, track trends, and identify growth opportunities through customizable reports. These insights enable businesses to make data-driven decisions, evaluate the success of their financial strategies, and adapt to changing market conditions. With comprehensive financial data, businesses can drive innovation and optimize their financial performance.

Online banking offers businesses a range of perks that enhance financial management, streamline operations, and provide valuable insights. Simplifying financial tasks and improving security, online banking has become an essential tool for businesses. Embrace the convenience and efficiency of online banking to take control of your business finances and unlock new growth opportunities.